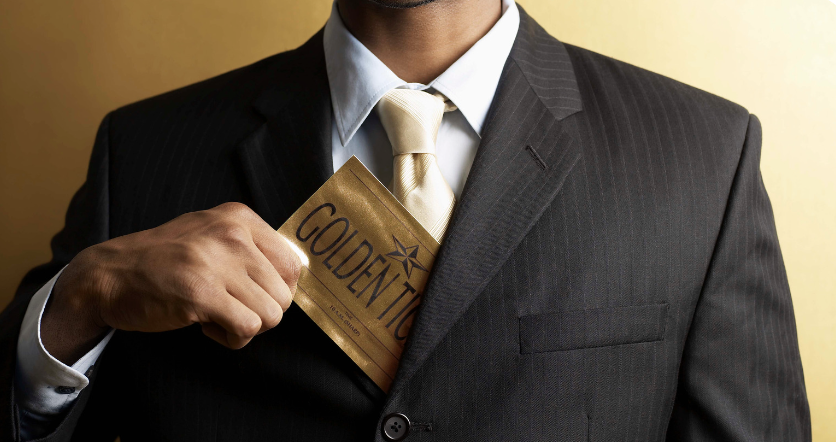

One of my all-time favorite movies is the original 1971 Willy Wonka movie with Gene Wilder. Every time I watch I still get excited as Charlie opens his candy bar and finds the golden ticket which changes the trajectory of his life! Well, my topic in this blog is a little like that golden ticket in that it can greatly change the trajectory of a business by helping support its next level of growth. In this blog, I’m talking about business credit and the easy steps you can take to build it.

It doesn’t matter whether a business has revenues in the 6-figures or the 8-figures, cash is Queen! Businesses may need additional capital for several reasons. For some, additional cash may be needed to enable business growth. Other times, the cash may be needed to stay afloat. In both scenarios, identifying another source of capital is often the logical next step to keep the show on the road. Whether it’s covering the gaps left by late-paying customers or fueling a grand expansion plan, loans can be unsung heroes in a business’s financial playbook.

The critical tool that makes these loans accessible and affordable is sometimes overlooked: good business credit. Think of it as your business’s golden ticket with the power to propel your business forward. In this blog, I’ll take you through the importance of business credit, how to check and monitor it, and the very simple steps you can take today to kickstart your journey into creditworthiness.

Why Business Credit Can Be Your Business’s Golden Ticket

Good business credit isn’t just a financial badge; it’s your ticket to a world of opportunities. Picture this:

It’s time to run payroll and pay your hard-working team but:

- a major customer delays payment,

- an expensive piece of equipment breaks down,

- a new growth opportunity requires a significant investment,

And the math on this one does. not. math!

That’s when a good credit score can become your golden ticket giving you the support you need when opportunities and/or the unexpected happen. It’s about thriving in the unpredictable world of business.

SIDE NOTE: While having a solid emergency savings plan should also be a part of your business strategy, there are times when additional outside capital is required.

If the above benefits aren’t enticing enough, good business credit also means you get to save some coins. The better your credit rating, the more likely you are to snag the lowest interest rates on loans and vendor financing. Furthermore, you can expect lower business insurance rates and better (longer) payment terms with vendors.

But wait, there’s more! Lenders and vendors may take a peek at your score to evaluate your creditworthiness, especially if your business credit profile is still new.

Checking and Monitoring

Now that we’ve established the importance of business credit, you may be wondering how to check and monitor your score. To check your score, look to any of the following agencies. Most offer a no-fee option.

- Dun & Bradstreet (D&B)

- Experian Business

- Equifax Business

Getting Started: Establishing Business Credit

Getting started is about as easy as starting your business because the first few steps are the same.

- Register the Business and Obtain an EIN – Make it official. Register, grab an Employer Identification Number (EIN) from the IRS, and you’re on your way!

- Open a Business Bank Account – If you have been around my content you know this is a MUST when it comes to establishing your company as a legitimate business.

- Consider a Business Credit Card – Having and regularly using a business credit card will allow you to build business credit steadily over time. Remember to pay off all bills on time.

- Grow Your Business – By growing your business’s revenues and profits, you are showing potential lenders that you can manage the business well, which is factored into the evaluation of creditworthiness.

Make Sure Your Books Are Tight

When it’s time to apply for the loan, lenders are interested in the story your financial statements tell about your business’s health, profitability and your ability as its leader to manage resources. The bottom line is they want to minimize risk and your statements help them gauge how much risk they are taking in lending your business money.

I realize that for some, debt is a four-letter word, but that is when it is misused. Debt, when used correctly, can be a critical and essential part of a business’s growth strategy. For growing and scaling businesses, utilizing debt is common.

💎Tip: Credit utilization refers to how much of the total credit available to a business that is used. So if you have a $50K credit card limit and use $25K, then credit utilization is at 50%. According to Experian, a good credit utilization rate is a low credit utilization rate. But if you must have a number, they recommend staying below 30%.

Credit utilization is important because your business’s credit utilization is considered during the loan application process.

Building business credit isn’t a sprint, it does take time. The beginning steps are simple, but consistency is key. If you need support pulling the financial areas of your business together, let us know. As business solutions experts, we have helped dozens of businesses untangle complex issues and clarify a path to greater profitability.

Schedule a Discovery Session to learn more.